2025 Medicare Deductibles And Premiums Tax Deductible - 2025 Medicare Premiums & Deductibles Revealed! (The Everything Medicare, The maximum part d deductible for 2025 is $545 per year (though some plans waive the deductible completely). 2025 medicare part a, part b, and part d cost sharing amounts were released. Medicare premiums for 2025 will increase. Here’s what you need to know.

2025 Medicare Premiums & Deductibles Revealed! (The Everything Medicare, The maximum part d deductible for 2025 is $545 per year (though some plans waive the deductible completely). 2025 medicare part a, part b, and part d cost sharing amounts were released.

The annual deductible for medicare part b will increase by $14 in 2025 to $240, while the standard monthly premium for medicare part b will increase by $9.80 to.

Medicare Part A Deductible For 2025 Gabbey Arliene, Here's what you need to know. The 2025 part a deductible is $1,632 for each inpatient hospital benefit period before original medicare starts to pay.

Medicare Part B Premium 2025 Cost Chart, 2025 medicare part a, part b, and part d cost sharing amounts were released. The annual deductible for all medicare part b.

What Is The Medicare A And B Deductible For 2025, Yes, your medicare premiums can be tax deductible as a medical expense if you itemize deductions on your federal income tax return. Learn about monthly premiums, deductibles, and benefits.

Medicare Part A Deductible For 2025 Gabbey Arliene, A deductible is the amount of money you must pay for covered services out of your own pocket before your. How much is the medicare deductible for 2025?

2025 Medicare Premiums and Deductibles Senior HealthCare Solutions, For medicare part b, the standard monthly premium has risen to $174.70 for 2025, marking a rise of $9.80 from $164.90 in 2023. 2025 medicare premiums, deductibles and coinsurance amounts.

2025 Medicare Premiu … Pammi Barbette, For medicare part b, the standard monthly premium has risen to $174.70 for 2025, marking a rise of $9.80 from $164.90 in 2023. The standard monthly premium for medicare part b enrollees will be $174.70 for 2025, an increase of $9.80 from $164.90 in 2023.

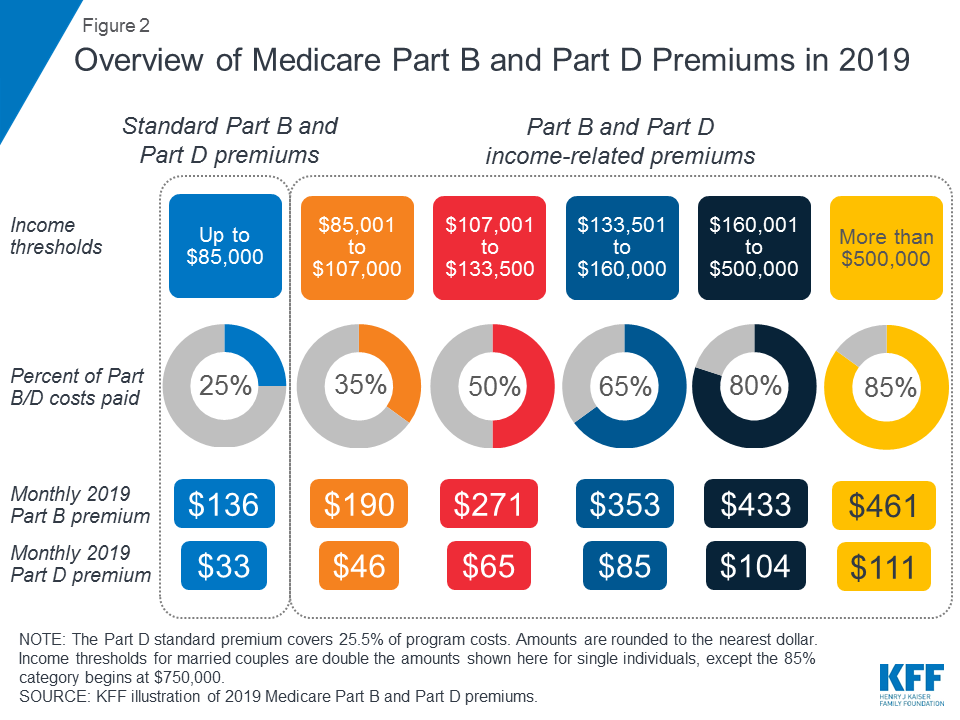

2025 Medicare Deductibles And Premiums Tax Deductible. The standard monthly premium for medicare part b enrollees will be $174.70 for 2025, an increase of $9.80 from $164.90 in 2023. For full coverage in 2025, irmaas range from $69.90 to $419.30.

The standard monthly premium for medicare part b enrollees will be $174.70 for 2025, an increase of $9.80 from $164.90 in 2023.

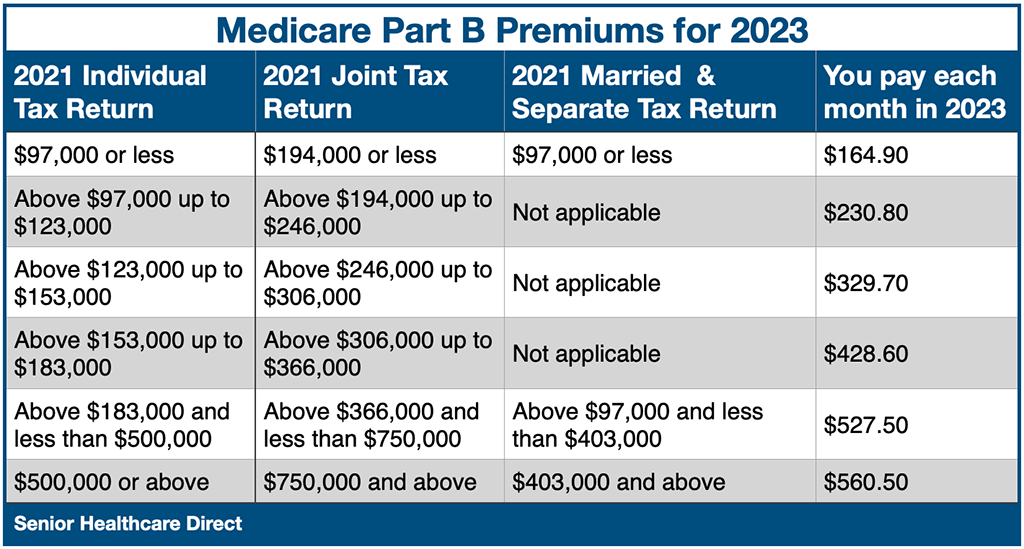

In 2025, medicare beneficiaries with reported income of more than $103,000 (filing individually) or $206,000 (filing jointly) in 2025 pay from $244.60 to $594 a month for.